NFT staking opportunities are increasingly opening new avenues for savvy investors within the vibrant NFT market. Rather than merely holding onto digital collectibles, you can significantly enhance the value of your assets through NFT staking. This presents an excellent method to generate passive income and engage more profoundly with the rapidly expanding blockchain ecosystem.

Contents

What is NFT staking?

NFT staking is essentially the process of locking your NFTs into a smart contract on a platform or blockchain protocol for a certain period. In return, you receive rewards, often in the form of the project’s utility tokens, governance tokens, or even other NFTs.

You can think of NFT staking as similar to traditional cryptocurrency staking (e.g., in Proof-of-Stake mechanisms), where users lock their tokens to support the network’s operations and security, receiving rewards in return. With NFTs, staking not only helps generate profit but can also offer other benefits depending on the specific project.

How does NFT staking work?

The NFT staking process typically unfolds as follows:

- Choose a platform/project: Look for NFT projects that offer staking programs. It’s crucial to thoroughly research the project, its development team, roadmap, and community.

- Connect your wallet: Connect your cryptocurrency wallet (e.g., Metamask, Trust Wallet) to the staking platform. This wallet must contain the NFTs you wish to stake.

- Select NFTs to stake: Choose the specific NFTs from your collection that you want to stake. Some projects may require NFTs from a particular collection or with specific attributes.

- Confirm the transaction: Approve the staking transaction in your wallet. This will lock your NFTs into the smart contract.

- Receive rewards: Once your NFTs are staked, you will start accumulating rewards according to the rate and schedule set by the project. Rewards can be withdrawn to your wallet periodically or when you decide to unstake.

The various NFT staking opportunities often come with different terms regarding minimum lock-up periods, annual percentage yield (APY), and reward types.

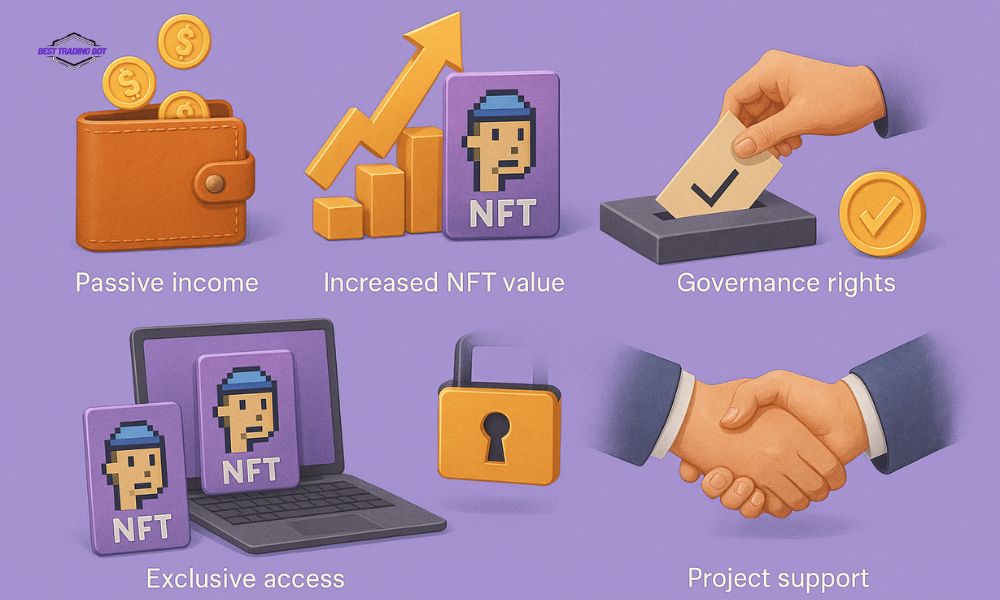

Benefits of exploring NFT staking opportunities

Participating in NFT staking opportunities offers several potential benefits:

- Passive income: This is the most obvious benefit. Instead of letting your NFTs sit idle in your wallet, you can make them work for you and generate a new income stream.

- Increased NFT value: Staking can increase demand and reduce the circulating supply of NFTs, potentially boosting their market value.

- Governance rights: Some projects reward NFT stakers with governance tokens, allowing them to participate in the project’s decision-making process.

- Exclusive access: Staking NFTs can unlock exclusive benefits such as early access to new features, special events, or other rare NFTs.

- Project support: By staking your NFTs, you are showing support and contributing to the development of a project you believe in.

Risks to consider when seeking NFT staking opportunities

While appealing, NFT staking opportunities also come with certain risks:

Smart contract risk: Smart contracts can contain bugs or security vulnerabilities, leading to a risk of asset loss.

Market volatility: The value of both the staked NFTs and the reward tokens can fluctuate significantly, affecting actual profits.

Lock-up periods: Some staking programs require you to lock your NFTs for a long time, reducing the liquidity of your assets.

Project risk: The project may not succeed or could even be a scam (rug pull), rendering your NFTs and rewards worthless.

NFT liquidity: If you need to sell your NFT urgently while it’s staked, you might have to unstake and miss out on rewards, or you might not be able to sell quickly if the NFT has low liquidity.

How to find and evaluate NFT staking opportunities

To make the most of NFT staking opportunities, you need to conduct thorough research:

- Research the project (DYOR – Do Your Own Research): Learn about the team, whitepaper, roadmap, tokenomics, and community of the project.

- Evaluate APY and staking conditions: Compare reward rates, lock-up periods, and other requirements among projects. Don’t just be lured by high APY without considering the risk factors.

- Check security: Prioritize projects whose smart contracts have been audited by reputable firms.

- Consider the liquidity of NFTs and reward tokens: Ensure you can easily trade them if needed.

- Engage with the community: Follow the project’s social media channels and forums to get updates and community feedback.

Finding good NFT staking opportunities requires patience and caution. Don’t rush into any program you don’t fully understand.

Ultimately, NFT staking opportunities offer a smart way to earn from your digital assets, despite inherent risks. Diligent research is crucial. For continuous updates on NFTs, blockchain, and emerging tech trends that can enhance your portfolio, remember to follow Best Trading Bot for insightful analysis.